Form 433-F Instructions, How to File, and When to Get Help With This Form

When you can’t afford your tax bill, you have options to pay off your balance over time, settle your debt, or pause collections temporarily. If you’re pursuing an option like the currently not collectible (CNC) status, you’ll usually use Form 433-F to provide personal or business financial information to the IRS.

You may also need to file this form if you apply for a payment plan and owe over $50,000, can’t make the minimum monthly payment, or have a history of defaulting on payment plans.

This post walks through situations when you would need to file Form 433-F. It also explains how to file Form 433F and offers tips for completing it correctly.

Work with a tax expert if you have questions. At Damiens Law, we have over 10 years of experience helping taxpayers deal with IRS, state, and local taxes. Our law firm specifically focuses on tax debt resolution, and we can help you get relief from your tax problems.

Table of Contents

- What Is IRS Form 433-F Used For?

- When You Need to File Form 433-F

- Instructions for Form 433-F

- When to Get Help with Form 433-F

- Where to Send Form 433-F

- Comparing Other 433 Forms, Including A, B, D, and H

- Get Help With Your Tax Debt

What Is IRS Form 433-F?

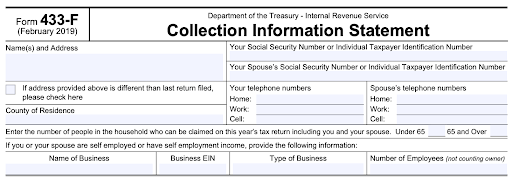

Form 433-F is a type of collection information statement. The IRS uses this form to collect information about your financial situation to determine if you can afford to pay your tax bill. You may have to fill out this form if you request a payment plan or if you want to stop collection actions due to financial hardship.

The form requires detailed information about your income, assets, debts, and expenses. Note that you must include everything requested on this form — hiding assets from the IRS can lead to tax fraud or tax evasion charges, which you always want to avoid.

When to File IRS Form 433-F

The IRS uses Form 433-F in a few different situations. If any of the following apply, you need to file this form:

You request a payment plan on more than $50,000 in tax debt.

When you apply for an installment agreement, you must complete Form 433-F if you owe more than $50,000 in tax, interest, and penalties.

The good news is that you can make a downpayment before you submit your application, and if the payment gets your balance below the $50,000 threshold, you don’t have to complete this form.

You owe over $25,000 and don’t set up a direct debit for the monthly payments on your installment agreement.

If you are trying to set up an installment agreement and you owe between $25,000 and $50,000, you must set up the payments to come automatically from your bank account. If you don’t, you must submit Form 433-F to the IRS. Again, if you make a downpayment with your application, you can skip this step if you get your balance below $25,000.

Generally, it’s much easier to set up automatic debit payments than it is to file Form 433-F. If you don’t have a bank account, you can ask your employer to withhold the payments from your paycheck and send them to the IRS. This is called a payroll deduction, and this option requires you to complete Form 2159 (Payroll Deduction Agreement).

Note, however, that your employer may be able to assess a small fee to cover the cost of withholding and submitting the payment.

You can’t afford the minimum payment on your installment agreement.

When you apply for an installment agreement, you calculate your minimum monthly payment by dividing your balance by 72. However, if the collection statute expires in the next six years, you should divide your balance by the number of months between now and the collection statute expiration date.

The result is your minimum monthly payment. You can offer to pay more per month if you can, but if you can’t afford the minimum, you need to provide the IRS with Form 433-F to explain why.

You want to apply for currently not collectible status.

Currently not collectible status is something the IRS grants taxpayers when they’re unable to pay their tax bill because of a financial hardship. If you qualify and prove your situation through documentation, the IRS will mark your account as currently not collectible and pause all collection actions against you.

However, this doesn’t mean that your tax debt goes away. The IRS will periodically review your situation, and if your finances improve, the agency may demand payment. The only way you won’t have to repay what you owe is if the statute of limitations expires while your account is in currently not collectible status, which is 10 years from when the tax was assessed.

In some cases, the IRS may request Form 433-A (Collection Information Statement for Wage Earners and Self-Employed Individuals) and/or Form 433-B (Collection Information Statement for Businesses) instead of Form 433-F. However, all of these forms are very similar and serve to provide financial details to the IRS.

You need to prove financial hardship with Form 433-F to the IRS.

You may also need to file Form 433-F if you’re experiencing financial hardship. This can apply if you’re requesting currently not collectible status, as mentioned above. However, this form may also come into play if you’re suffering economic hardship due to a collection action such as a wage garnishment or an asset seizure. In these situations, the IRS will let you know if you need to file this form.

When you’re unsure if you should file Form 433-F, contact us. Our tax attorney can help you assess your finances and tax balance and find the best way forward. We explain how to file hardship with the IRS to pursue options like currently not collectible status.

Form 433-F Instructions

Form 433-F requires two pages of very detailed financial information. To prepare to complete this form, make sure that you have all of your most recent financial statements or the logins for your online accounts. You also need details about your income and your expenses. Here is what you need:

Asset Details

You need to include the following details about the assets you own:

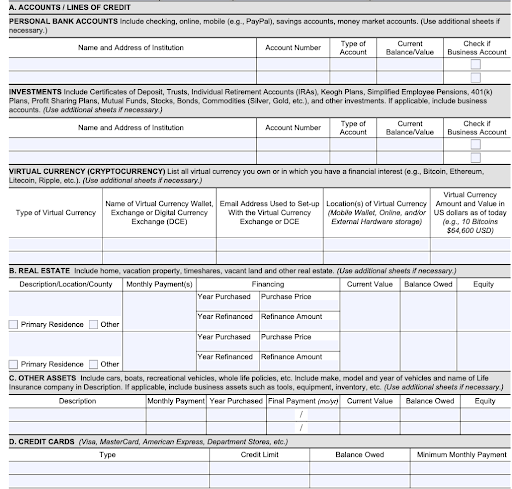

- Account numbers, institution names, and current balance of all bank accounts and online payment accounts

- Account numbers and balances for all investments such as certificates of deposits (CDs), trusts, mutual funds, IRAs, 401(k)s, and other investments

- Value of virtual currency, including names of wallets and exchanges

- Real estate details including purchase date, purchase price, refinance details, current value, balance owed, and equity, including your primary residence as well as any other properties you own

- Description, fair market value, and loan details for all other assets such as vehicles, recreational vehicles (RVs), boats, and cash-value life insurance policies

- Credit card limits, balances, and minimum monthly payments

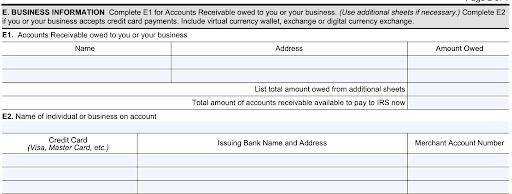

Business owners should also note the accounts receivables owed to the business and details about their merchant accounts. In some cases, the IRS may also require you to complete Form 433-B if you own a business. Form 433-B goes into deeper detail about your business assets, business credit cards, and business revenue and expenses.

Employment and Self-Employment Income Information

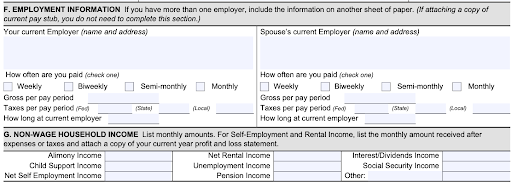

Provide the name and address of your and your spouse’s employers in the employment information section. Then, you must note your pay period, your payment amount before and after tax, and how long you have been with your employer.

In the non-wage household income section, list any other income received by your household. This includes alimony, child support, business income, rental income, pensions, unemployment income, Social Security payments, and any other income that you receive.

Monthly Necessary Living Expenses

In the living expenses section of the 433-F form, you will list your expenses, including food, clothing, gas, insurance, utilities, medical bills, child care, and housekeeping supplies. You can also note your estimated tax payments and any monthly payments you make on delinquent state or local taxes.

In this section, you must note your actual expenses and the “IRS-allowed” expenses. To find the IRS-allowed expenses, look at the IRS’s collection financial standards. This is the amount that the IRS expects people to spend every month. The IRS has national allowances for certain expenses, while others such as housing and utility costs vary based on where you live.

If you cannot find the IRS’s financial standards, you can leave those boxes blank. However, it’s in your best interest to understand the standards before you apply because they affect your chances of approval.

Allowable vs. Actual Expenses

If your expenses in any category are lower than the allowable amount, you can note the allowable amount instead of your actual expense. However, you should note the actual expense if it is higher than the allowable amount. You may have to explain your expenses if they exceed the IRS’s allowances.

Unfortunately, the collection financial standards can be fairly low, especially for housing, food, and medical costs. If your expenses exceed the standards, you may struggle to get the result that you want when you file Form 433-F.

For example, if your monthly grocery bill exceeds the amount that the IRS believes you should be spending, the IRS may reject your application. Similarly, the IRS may not let you include expenses such as credit card payments or private school tuition.

If your records show spending that the IRS deems nonessential, the agency may believe you have disposable income that you could use to pay off your tax balance. However, if you can convince the agency that your expenses are for the health and welfare of your family, the agency may approve the expense.

When to Get Help With Form 433-F

Some taxpayers are comfortable completing IRS Form 433F on their own. However, never leave IRS issues to chance. A tax attorney can be critical if you’re dealing with a complicated situation and need to ensure you’re doing everything correctly.

Here are the signs you should contact a tax professional to help you:

- You’re confused about how to complete Form 433-F.

- You’re not sure if this is the right form for your situation.

- You’re tired of dealing with the IRS on your own.

- You’re being bullied by an IRS employee.

- You’re worried that if you reveal assets, the IRS may demand full payment.

- You have assets that you could sell to pay off the tax debt, but you use them to generate income.

- You want to apply for an offer in compromise (OIC) or a partial payment installment agreement (PPIA) to settle your tax debt for less than you owe.

- You need help applying for penalty abatement.

- You think the tax due is related solely to the actions of your spouse or former spouse.

- Your expenses exceed the IRS allowances.

These scenarios all warrant a second look from an expert. Remember that the IRS can be very strict in its definition of financial hardship. Essentially, the agency believes that you should be devoting all of your disposable income to repaying your tax debt. If you have equity in assets or extra money, the IRS thinks that you should use these funds to pay down your tax debt.

This is where a tax attorney can be critical. They can help you convince the IRS that you need to spend more than the allowable amounts. Often, this can be the deciding factor of whether you’re approved for an installment agreement, currently not collectible status, or economic hardship.

Where Do I Send Form 433-F?

The IRS Form 433-F mailing address varies based on the situation. If you’re submitting this form to request hardship or currently not collectible status, contact the IRS directly to see where to submit the form. When filing this form with your installment agreement application, send it to the address on your installment agreement form.

If you have received notices about your outstanding tax balance or penalties, use the information provided on your notice to contact the IRS.

Other Collection Information Statements in the Form 433 Series

The IRS generally uses 433 forms to collect financial information from taxpayers. Then, the IRS uses this information to determine how much you can afford to pay on your tax debt.

For example, say that you tell the IRS you can’t afford to pay anything per month. The IRS requests Form 433-F, and on the form, you indicate that you have $20,000 in equity in a boat and $50,000 in a retirement account. In this situation, the IRS may make you liquidate those assets so that you can pay off your tax debt.

The IRS also uses Form 433-A and 433-B to collect financial information about individuals and businesses, respectively. (These forms also have a Spanish version, noted by an SP after the form name.) There are also versions of these forms designed specifically for taxpayers who want to apply for an offer in compromise. These include Form 433-A (OIC) and Form 433-B (OIC).

Form 433-H allows you to request an installment agreement and make a financial disclosure at the same time. It is called the Installment Agreement Request and Collection Information Statement. The IRS requests this form when you owe more than $50,000 or can’t afford to pay off your tax liability within six years.

However, the IRS also uses Form 9465 (Installment Agreement Request) and Form 433-F (Collection Information Statement) for this same purpose. A tax attorney can help you figure out which forms you need for your situation.

Finally, if you set up a payment plan, you will probably need to complete Form 433-D. This form lets you set up a direct debit for your monthly payments. It also outlines the terms of your payment agreement, and by signing the form, you agree to these terms.

Always be sure you’re using the latest version of these IRS forms. The IRS has the most update-to-date PDF versions of these forms on its website.

Contact Us for Help With Your Tax Debt

Dealing with the IRS can be complicated and frustrating, to say the least. However, you can’t just ignore your tax obligations. You may be subject to penalties and collection actions such as liens, wage garnishments, and asset seizures if you don’t pay. To protect yourself, work with a tax professional all along the way to resolution.

At Damiens Law, we provide each of our clients with individualized attention to help them get the best result possible for their situation. Unfortunately, the IRS tends to push delinquent taxpayers into payment plans they can’t afford, leading to a high rate of default.

We work closely with our clients to help them get a sustainable resolution that helps them stay compliant with taxes moving forward.

Wondering how to deal with your delinquent taxes? Need help with the 433-F form? Contact Damiens Law today.