Form 433-A is a collection information statement for self-employed individuals and wage earners. The IRS uses this form to gather information about your monthly household income, living expenses, business and personal assets, and debts. Then, the IRS uses this information to assess your eligibility for certain tax relief programs.

Key Takeaways:

- Form 433-A – IRS collection information statement

- Who? Used by individual wage earners and the self-employed.

- What? Collects info on your income, expenses, and assets.

- When? Required for some payment plans and relief options.

- Why? Lets the IRS review your eligibility for tax relief.

Need help completing IRS Form 433-A? Want to ensure you’re pursuing the right option for resolving your tax debt? At Damiens Law, we are devoted to helping our clients resolve their tax issues in the most optimal way possible. Contact us today.

To help you get started, we created this complete guide to Form 433-A.

What Is Form 433-A?

Form 433-A is the Collection Information Statement for Wage Earners and Self-Employed Individuals. An IRS revenue officer may ask you to complete this form if you are trying to set up an installment agreement and you owe over $50,000.

You may also need to complete this form if you’re applying for a partial payment installment agreement (PPIA). The IRS also uses this form to determine how much you can afford to pay if you’re liable for a trust fund recovery penalty (TFRP).

Another version of this form is the 433-A (OIC). You should complete this form if you’re applying for an offer in compromise.

Both of these forms request detailed information about your income, expenses, assets, and debts, and you need to ensure that you fill in the forms accurately. Failing to include all of your assets or income may be considered tax evasion. A tax professional can help you review the form and complete it properly.

When to File Form 433-A

So, when is this form used? Do all taxpayers need to complete Form 433-A? Here are the main situations when you may need to file tax Form 433-A:

- To apply for an installment agreement

If you owe over $50,000, the IRS generally requires additional financial information before approving a monthly payment plan. Typically, the agency uses Form 433-F in this situation, but if a revenue officer is assigned to your case, they may request Form 433-A. You may also need to complete this form if you owe over $25,000 but don’t want to set up auto payments from your bank account.

- To apply for a partial payment installment agreement (PPIA)

A PPIA lets you make agreed-upon monthly payments on your tax debt until the collection statute expiration date — generally 10 years after your tax return was filed. Then, the IRS discharges any remaining debt. The IRS can no longer collect after that statute expiration date.

You will only qualify for a PPIA if you cannot afford to pay the tax debt in full or make larger monthly payments. The agency uses the information on Form 433-A to assess your ability to pay. The IRS will then reassess your situation every two years to determine if you can pay more.

- If you’re personally liable for a TFRP

The Trust Fund Recovery Penalty applies when businesses don’t pay their payroll taxes, and the IRS can hold a range of individuals responsible. If you are personally liable for a TFRP, the IRS will ask you to complete Form 433-A to assess your collection potential.

- To apply for an offer in compromise.

With an offer in compromise, the IRS agrees to let you pay off your tax debt for less than you owe. Again, the IRS won’t settle tax debts unless you prove that you cannot afford to pay the tax liability by filing a collection information statement. For an OIC, you should file the 433-A (OIC) instead of the standard version of this form.

In some cases, the IRS may require you to file Form 433-A to see if you qualify for certain tax relief programs. You should never hide information from the IRS, but if you’re uncomfortable with the request, you should reach out to a tax professional to get your questions answered.

At Damiens Law, we work closely with our clients to provide them with individualized attention and services. We ensure that the IRS collection agent respects your rights and will help you find the best relief option for your situation.

Form 433-A Step-by-Step Instructions

Form 433-A requests details about nearly every aspect of your finances. Set aside plenty of time to complete this form, and be aware that you may need to really dig into your financial records to find the information you need. Here is an overview.

Step 1: Contact Details and Wage Information

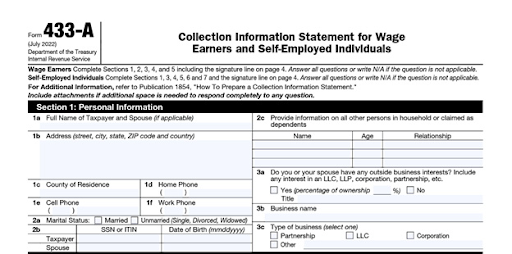

The first two sections of Form 433-A are self-explanatory. For section one, you need your contact details, Social Security number, and date of birth. You also need your driver’s license number and details about your spouse and dependents, if applicable.

Then, in section two, you note your employment information including your employer, pay dates, and withholding information. If you’re self-employed, you can skip this section.

Step 2: Other Financial Information

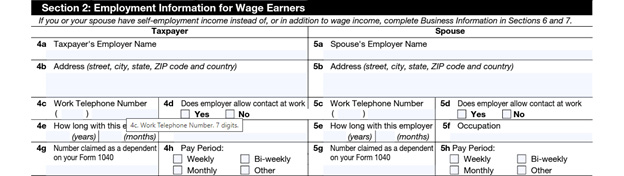

Section three of IRS Form 433-A asks questions about the following:

- If you’re currently party to a lawsuit

- If you’ve ever filed for bankruptcy

- If you’ve lived outside the United States for more than six months or longer in the last decade

- If you’re the beneficiary of a trust, estate, or life insurance policy

- If you have a safe deposit box

- If you’ve transferred business or personal assets for less than their fair market value in the last 10 years

You need to attach supporting documents related to these questions when you file.

Step 3: Personal Asset Information

Section four of Form 433A asks for detailed information about your personal assets. You must disclose all of your assets, including bank accounts, money market accounts, investments, life insurance policies with cash value, real estate, vehicles, and virtual currency.

You also have to list the value of your furniture, art, jewelry, and collectibles and any intangible assets you own.

The form requests the fair market value and the outstanding loan balance on all of your personal assets. You also need to note account numbers, addresses of financial institutions, and other details as requested. For instance, when you list the value of your virtual currency, you have to include the email address you used when you set up the wallet or exchange.

Step 4: Monthly Income

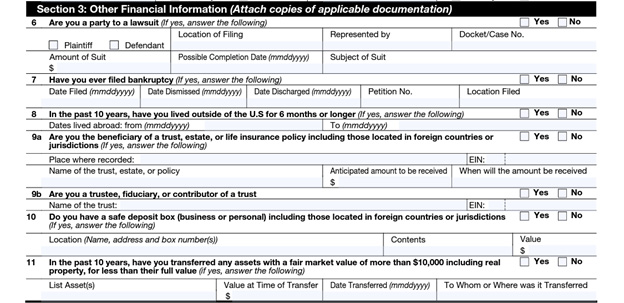

In section five, provide your monthly income and expenses to determine how much you can afford to pay each month. This is the last section for wage earners. If you’re self-employed, you need to complete sections six and seven before completing this section.

Note all your income sources, including wages, dividends, net rental income, business income, pensions, distributions from retirement accounts, Social Security payments, child support, alimony, and any other income you receive. Then, list all of your expenses. The difference between income and expenses is your disposable income. Generally, the IRS expects you to spend all of your disposable income on your tax debt.

Step 5: Actual vs. Allowable Amounts for Expenses

In the expense section, Form 433-A has two columns: actual and allowable. Fill out the actual monthly expenses column with the expenses you pay every month. When the agent reviews your application, they will note the allowable expenses based on the IRS’s collection financial standards.

It’s important to note that the IRS doesn’t necessarily accept every expense as necessary. Generally, the agency will not allow you to include private school tuition, college expenses, charitable contributions, voluntary retirement contributions, or credit card payments.

The agency has specific guidelines for how much taxpayers should spend on food, housing, transportation, and other expenses. These are called collection financial standards. Some amounts are the same for everyone, while other expenses, such as housing, vary based on where you live.

If your expenses exceed the limits, the IRS may not allow you to include those expenses unless you have a good explanation of why you need to spend more than the threshold. The IRS may allow additional expenses if you convince the agency that they’re necessary for the welfare of your family or to earn a living.

For example, as of 2024, the IRS expects people under age 65 to spend $83 on out-of-pocket medical expenses and people over 65 to spend $158. If your monthly expenses exceed these thresholds, you need to explain why.

Step 6: Business and Sole Proprietorship Information

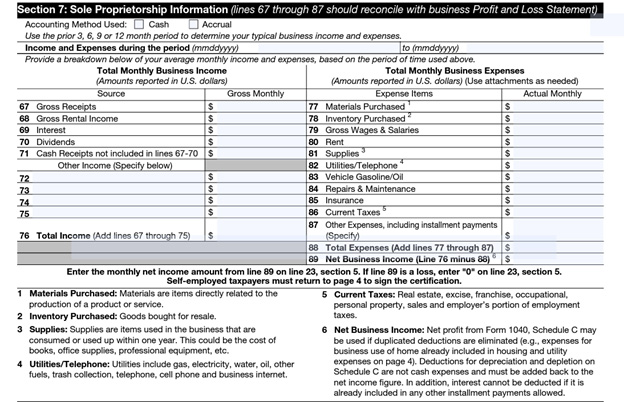

Sections six and seven request details about your business if you’re a sole proprietor. If you’re self-employed or an independent contractor, you are considered a sole proprietor. If your business is a partnership or a corporation, you should complete Form 433-B instead of filling out these sections.

You must include basic details about your business, such as its name, type, employer identification number (EIN), address, and website. You also need to list your payment processing accounts and the merchant account that you use to process credit cards. Then, you need to disclose how much cash you have on hand and list your business bank accounts.

You also need to include details about accounts receivables and the equity in your business assets. Create a detailed list of your business income and expenses corresponding to the information on your profit and loss report.

How to Complete Form 433-A OIC

As noted above, if you’re applying for an offer in compromise, you need to use a different version of this form called the 433-A OIC. The OIC version of this form requests the same details as the original version but in a slightly different order.

The 433-A OIC is two pages longer than the standard version of the form, and it requests a few additional details, including the following:

- Household members: In the personal and household information section, you need to list all the people who live in your home. Also note their relationship to you, if you claim them as a dependent, and whether they contribute to your household income.

- Asset equity calculations: The OIC form requires an additional calculation for personal and business assets aside from cash, cash equivalents, and life insurance policies with cash value. Multiply the fair market value of the asset by 0.8 and subtract the amount you owe. Then, note the difference to the side.

- Expense allowances: When you fill out your monthly income and expenses, you should note the national standard for out-of-pocket health care expenses (line 45) and food, clothing, and misc expenses (line 39), even if you spend less than this amount. For all other expenses, note the actual amount that you pay.

- Offer: On the last page of the OIC form, make your settlement offer. This is the amount that you are offering to pay so that the IRS will eliminate the remaining balance. You add up the value of your assets as calculated on the form. Then, you add in 12 months of disposable income if you plan to pay in a lump sum or 24 months of disposable income if you want to pay over a two-year period. The total is your offer amount.

If you want to make an offer that is less than the amount calculated based on the information on the form, you will need to provide the IRS with a written explanation. Even though this version of the form doesn’t show a column for IRS allowable expenses, keep in mind that the IRS refers to these standards when reviewing your application.

When to Provide Additional Explanations

As explained above, both versions of tax form 433-A require a lot of numbers. Although it’s rigorous, that part of the form is relatively self-explanatory. However, you may need to go beyond the numbers. This requires strong knowledge of the tax code, so working with a tax expert is important.

In particular, if you apply for an offer in compromise and make an offer that is less than the amount calculated on the form, you will need to include a written explanation of why the IRS should accept your offer. Per the instructions in Form 656-B,Offer in Compromise Booklet, you will attach a detailed explanation of your economic hardship to your form when you send it. This booklet also includes a helpful application checklist so you can be sure you’ve completed all steps properly.

In some cases, you may need to apply for effective tax administration. This is when you could afford to pay more, but forcing you to do so would be inequitable.

If applicable, you also must provide a written explanation if your business income is substantially different this year than the last.

How to file Form 433-A

The address where you should send this form varies. If you’re working with an IRS agent, they can let you know where to submit the form. If you’re applying for an offer in compromise or a PPIA, the address may be on the other forms that you fill out.

As per the 2024 update of the Form 433-A OIC booklet (Form 656-B), here are mailing instructions based on your state:

- AZ, CA, CO, HI, ID, KY, MS, NM, NV, OK, OR, TN, TX, UT, WA will send to:

Memphis IRS Center COIC Unit

P.O. Box 30803, AMC

Memphis, TN 38130-0803

844-398-5025

- AK, AL, AR, CT, DC, DE, FL, GA, IA, IL, IN, KS, LA, MA, MD, ME, MI, MN, MO, MT, NC, ND, NE, NH, NJ, NY, OH, PA, PR, RI, SC, SD, VA, VT, WI, WV, WY, or a foreign address will send to:

Brookhaven IRS Center COIC Unit

P.O. Box 9007

Holtsville, NY 11742-9007

844-805-4980

Other 433 Collection Information Statements

The 433-A and 433-A (OIC) are not the only forms the IRS uses to collect information about your finances. The agency also uses the following forms:

- Form 433-F (Collection Information Statement): A three-page long form typically requested if you apply for a payment plan on over $50,000 in tax debt or if you can’t afford to make the IRS’s minimum monthly payment.

- Form 433-B (Collection Information Statement for Businesses): A six-page form used to assess the collection potential of partnerships, multi-member LLCs, and corporations.

- Form 433-B (OIC): A six-page form for businesses applying for an offer in compromise.

- Form 433-D: Short form to agree to an installment agreement and set up automatic monthly withdrawals from your bank account.

- Form 433-H: Installment agreement request and collection information statement, used in some cases to set up payment plans for individuals.

To avoid processing delays, make sure that you file the correct forms with the IRS. Although all of these forms are relatively similar, they have nuanced differences in the information that the IRS wants to collect.

Common Mistakes with Form 433-A

Unfortunately, many taxpayers face roadblocks when completing Form 433-A that can delay processing times or cause further headaches with the IRS. Watch for these common mistakes:

- Inaccurate information: Make sure all details, including personal and financial, are accurate and up to date. Carefully review expense and income amounts and double check everything before submitting.

- Missing financial information: Never leave off financial details that you think aren’t important for this request. You must include everything to the best of your knowledge. Don’t try to hide assets from the IRS, which will just lead to more trouble.

- Failing to pay: Once the offer or payment plan is accepted, you must pay the agreed-upon amount to the IRS, or you risk the arrangement being revoked.

- Overspending: The IRS looks closely at the bank account information you provide. If the agency sees that you’ve been spending frivolously, they may not approve your offer because it will appear that you have disposable income that could cover your tax bill.

- Not getting help: When you’re completing Form 433-A or Form 433-A OIC, be sure to talk to a tax professional about everything you need to provide to move forward.

Get Help With Tax Problems Today

Dealing with the IRS can be complicated and frustrating. Often, when taxpayers handle these issues on their own, they end up paying more than they should because they don’t understand the tax code or the available options.

When you work with Damiens Law, we help you understand the options for your situation, and we ensure that you get the best arrangement possible. Contact us today for help. We’ll start with a conversation about your tax problems and then make a plan to resolve them as quickly and painlessly as possible.

FAQs about Form 433-A

When Do I Need to Send Form 433-A to the IRS?

This form is used by wage earners and self-employed individuals when they can’t afford to pay their tax bill and they’re looking for relief through a PPIA or offer in compromise. A revenue officer may also request this form if you’re applying for an installment agreement and owe over $50,000.

How Is Form 433-A OIC Different from Form 433-A?

The IRS uses Form 433-A to assess eligibility for certain payment plans. Form 433-A OIC is for offer-in-compromise requests from wage earners and self-employed individuals, and it asks for more information than the other version.

Why Does the IRS Ask About My Income and Expenses?

The IRS wants to know your financial situation to determine whether you can pay your tax balance in full or if you qualify for a relief option that will settle your debt.

Where Can I Find Form 433-A?

You can download Form 433-A or Form 433-A OIC directly from the IRS website, or you can get these forms from a tax professional.