As the end of the year rapidly approaches, many taxpayers are looking for ways to reduce their taxable income. One popular method is to donate to charitable organizations. But what many people don’t know is that there are tax deductions available for these donations. Here’s a look at what you need to know about charitable tax deductions.

Charitable deductions are available to taxpayers who make a cash gift to a qualified charity. These donations can be made via check, credit card, or debit card. If you don’t itemize deductions, your cash gift must go to a qualified charity. However, if you choose to itemize deductions, you may receive a higher write-off in 2022.

What is a charitable tax deduction?

The IRS allows taxpayers to take a charitable deduction for donations to nonprofit organizations. If you donate more than the charity reimburses you for the goods or services, you can write off the difference in your adjusted gross income. To take advantage of this deduction, you must submit Form 8283.

Donation vs deduction

Sometimes the amount that we donate is not the same as the amount that you can deduct on your taxes. This can be confusing and difficult to remember when filing our taxes.

The amount you can deduct for your charitable donations depends on the type of donation you make and the value of the contribution.

For example, if you give $1,000 to a local food pantry, you can take a deduction for that amount. But if you donate $2,400 to a charity that provides food for hungry people, you can deduct only up to $1500.

It is important to consider how you are filing, too

Depending on your income, or your spouse’s income, it can be a bit more tricky to decide how you are going to file your taxes. Many people think that once they are married, they can only file their taxes with their spouse. However, you have the option to file separately. Depending on a person’s specific situation, it might be more lucrative to file jointly or separately.

Read more about how changing your tax filing status can help improve your finances.

If you are married, filing jointly, and do not itemize your deductions, you may want to use the standard deduction instead. However, if you have a high adjusted gross income (AGI), the standard deduction will exceed your charitable contributions.

Generally, your charitable deductions will not exceed 25 percent of your taxable income. Therefore, you’ll want to group them into one year to get the most benefit from your charitable donations.

In addition to monetary donations, charitable contributions of household items, clothing, and property may also qualify for a tax write-off. However, these items must be in good condition and given to an organization that will sell or use them. In addition, donations must be made in cash or property prior to year-end in order to qualify for the deduction.

The most common types of charitable donations to be claimed

There are many different ways to reduce your tax bill, including donations to charitable organizations. You can generally deduct up to 50% of your adjusted gross income (AGI) from your contributions to nonprofits.

Celebrities and super-rich individuals frequently donate large amounts of money to charities. But if you want to take full advantage of your charitable tax deduction, you must know which types of contributions qualify.

Documentation, documentation, documentation!

Donations made by check, cash, or credit card should be accompanied by a written acknowledgment from the nonprofit organization. This document should include the dollar amount of the donation and a description of the property donated, if applicable.

It should also state if the charitable organization provided any goods or services in return for the payment. If you make automatic deductions from your paycheck, keep a copy of your W-2 and pay stub.

The most common type of donation to be claimed for charitable tax deductions is a cash donation. However, non-cash donations are also tax-deductible, as long as they meet IRS guidelines. To qualify, non-cash donations must meet certain criteria, including being in good condition.

How much can you deduct for charity each year?

The federal government offers a deduction for donations to qualified charities. In the US, this deduction can be as much as $300 per person or $60 per married couple filing jointly. But it is important to know that donations to charities are subject to certain limits.

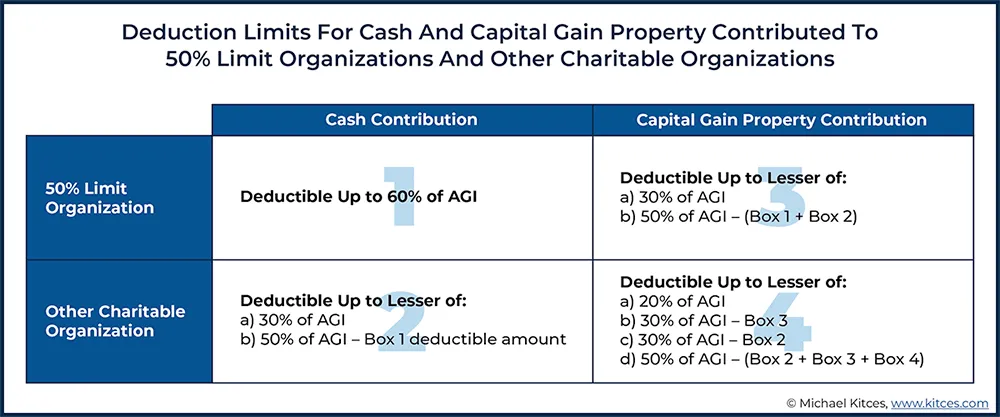

Generally, you can only deduct as much as 60% of your AGI for cash contributions, while the deduction for property and capital gain property is limited to 30% of AGI.

What qualifies as a charity?

Other expenses that can be deducted include medical and dental expenses, state and personal property taxes, mortgage insurance premiums, and investment interest. However, to qualify for a charitable deduction, the donation must be made to a tax-exempt 501(c)(3) organization.

A legitimate charity should be able to provide you with proof of its tax-exempt status. You should be careful, however, to avoid falling victim to scams that claim to represent legitimate charities or a donor-advised fund.

The charitable deduction cap can be tricky. It is often impossible to know how much money you can deduct for charity without knowing your net income. For this reason, it is important to consult with a qualified tax attorney or advisor before donating large amounts of cash.

Restrictions on who can claim a charitable contribution deduction

There are a number of restrictions on who can claim a charitable deduction. Generally, the limit is 60 percent of federal adjusted gross income (AGI) for cash contributions. For property donations, the limit is fifty percent of AGI and thirty percent for gifts of appreciated property.

However, any excess amount of charitable giving can be carried forward for five years.

Limitation on donations based on debt

In addition, the deduction cannot exceed the interest equivalent of any debt. A bond is a security that is not deductible from the taxpayer’s gross income.

Similarly, the deduction for an intangible religious benefit cannot exceed the value of the benefit provided by a religious organization. This is because the benefit is not generally sold in a commercial transaction outside the donative context.

The Taxpayer Certainty and Disaster Tax Relief Act of 2020 enacted provisions to help people who donate to charities. In particular, the CARES Act extends four temporary tax changes that benefit charitable contributions. These changes will benefit people who itemize their deductions.

Tax-deductible donation types by the IRS

Charitable deductions are allowed when you donate money or property to a qualified organization. You must receive a written receipt from the organization describing the gift you made. You must also maintain a bank record of the contribution. Moreover, you must keep a

record of all contributions made to a qualified organization, including checks and cash.

Cash

Cash donations can be made via check, credit card, electronic funds transfer, or payroll deduction. The amount you can deduct is up to 60% of your AGI, provided the donation was made to a qualified organization.

Household items

In addition to cash donations, you can donate household items, such as furniture, clothing, and household goods. However, the items you donate must be in good condition and in good working order to qualify for a tax write-off.

Cash to A 501(c)(3)

Cash donations to qualified charities can be a tax deduction for taxpayers who do not itemize deductions. However, you must make sure that the contributions go to a nonprofit organization. If you make donations to nonprofit organizations that are not 501(c)(3) organizations, the donations don’t count as charitable donations.

Are there any special rules or restrictions?

Donations to charities are generally deductible from a taxpayer’s income. However, there are certain rules and restrictions that must be adhered to in order to deduct the full value of a donation.

For example, if the donation is for a piece of property, the taxpayer can only deduct the fair market value of the property. For more information, see IRS Publication 561, Determining the Fair Market Value of Donated Property

Donations to charitable organizations can be cash or non-cash items. The rules about charitable contributions vary by type of organization and business. Generally, contributions may be limited to 60% of an individual’s adjusted gross income (AGI).

However, if an individual is a small business owner, cash charitable deductions are generally limited to 20%, 30%, or 50% of AGI. There are also different rules for non-cash charitable donations.

If a charitable organization sells donated items, the taxpayer may be eligible for a deduction. For example, if the donation is for a shirt, the charitable contribution deduction limit is twenty percent of the shirt’s fair market value. The deduction limit is higher for C corporations, whereas for other businesses, it is based on total net income.

Things to keep in mind when making charitable contributions

Donations to nonprofits can be tricky if you don’t understand the regulations. A financial expert can advise you on the best way to donate and help you file your taxes. Donors can also ask the charity representative for specific information. For example, they can ask about the number of clients they serve each year or major program accomplishments.

It is important to check the organization’s legitimacy and reputation. Be suspicious of vague claims and requests for a check made payable to the organization. Also, if a charity asks you to give a gift card or wire transfer money, make sure it is legitimate. Don’t give cash or credit cards to a charity that promises to enter you into a sweepstake. If the organization doesn’t provide any documentation, you won’t win any prizes and you’ll end up losing money.

It is also important to keep good records when making charitable donations. These records make tax time easier and can also avoid any legal ramifications. Donating to charities that have IRS-approved status is a wise move because it allows you to make a tax-deductible donation.

Work with an experienced tax attorney

If you are still curious about how much you are eligible to deduct for charitable contributions, sit down with an experienced tax attorney like Joseph Damiens. In the world of taxes it is significantly easier and cheaper to get the information you need and do it the right way, then guess and try to fix your mistake!

Giving money to charity is a beautiful thing and is done from the kindness of our hearts. As we enter the holiday season, it is important to keep this information in the back of our heads so that come tax season, all of our donations have the proper documentation!

The team at Damiens Law is here to help people navigate the confusing and stressful world of taxes. We help you get full advantage of tax benefits, know when it’s time to change your filing status, and much more. Call Damiens Law Firm, PLLC at (228) 300-8740 or send us a message online today.